Difference between revisions of "LynEx (LYNX)"

m |

m |

||

| (2 intermediate revisions by the same user not shown) | |||

| Line 19: | Line 19: | ||

=== Admin Keys === | === Admin Keys === | ||

* From their [https://lynex.gitbook.io/lynex-docs/protocol-overview/lynx-gauges docs] (7-2023): | |||

''"Emergency "Council": A dedicated Council with Lynex core team members initially and later joined by community members and DeFi experts is empowered with important functions. They have the authority to take actions such as killing unproductive gauges, halting LYNX emissions to them, reviving killed gauges, and modifying the [[Multi-Signature|MSIG]] address."'' | |||

=== DAO === | === DAO === | ||

| Line 25: | Line 29: | ||

=== Treasury === | === Treasury === | ||

* From the [https://lynex.gitbook.io/lynex-docs/tokenomics/initial-supply docs] (7-2023): | |||

"''A total of 16% from the initial supply has been set aside for the DAO treasury. This allocation will be locked in veLYNX for 24 months and used to vote on the most capital-efficient and profitable pairs. Additionally, the fee revenue generated will be utilized to cover operational expenses of the DAO."'' | |||

The treasury is in the hands of the team: | |||

''"A 4% portion of the emissions is allocated to the treasury. The LYNX tokens in the treasury are used at the team's discretion to support various initiatives, including incentivizing core pools, funding developments, and marketing. The team has the flexibility to allocate these tokens strategically for the benefit of the project and its ecosystem."'' | |||

== Token == | == Token == | ||

| Line 31: | Line 43: | ||

=== Token Allocation === | === Token Allocation === | ||

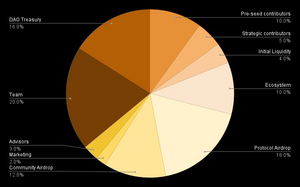

[[File:LynEx token allocations.png|thumb]] | |||

For all the exact numbers, check out their [https://lynex.gitbook.io/lynex-docs/tokenomics/initial-supply docs] (7-2023). | |||

=== Inflation === | === Inflation === | ||

* [[Liquidity Provider (LP)|LPs]] will be paid by LYNX inflation, veLYNX holders will be compensated by [[fees]] and rebases. | * [[Liquidity Provider (LP)|LPs]] will be paid by LYNX inflation, veLYNX holders will be compensated by [[fees]] and rebases. veLYNX mechanics [https://lynex.gitbook.io/lynex-docs/tokenomics/initial-supply include] a rebase capped at 52% with a weekly decrease. | ||

''""W'' | |||

''Weekly emissions (at inception): 5,000,000 $LYNX.'' | |||

# ''Weekly emissions decay: 1%'' | |||

# ''Weekly developer wallet allocation: 4%'' | |||

# ''Weekly veLYNX rebases: Starts capped at 52% then the cap is reduced by 1% every week for 52 weeks until it reaches 0%'' | |||

# ''Emissions for liquidity providers: starts at 44% and grows up to 96% in the a period of 52 weeks."'' | |||

=== Utility === | === Utility === | ||

==== Burns ==== | ==== Burns ==== | ||

* From the [https://lynex.gitbook.io/lynex-docs/tokenomics/protocol-revenue docs] (7-2023): | |||

''"The DAO Treasury holds veLYNX tokens to optimize liquidity and collect swap fees. These fees are used for various operational activities, such as LYNX token buybacks and burns, bribing core pools, and funding development efforts."'' | |||

=== Other Details === | === Other Details === | ||

| Line 57: | Line 83: | ||

=== Fees === | === Fees === | ||

* From the [https://lynex.gitbook.io/lynex-docs/liquidity-pools docs] (7-2023): | |||

"''The trading fees on Lynex are kept in the same tokens being traded. The fees are dynamic and based on market conditions and volatility.'' | |||

''You can provide liquidity without staking the LP tokens. In this case, you may earn all of the trading fees for your proportionate share of the pool. There are no deposit or withdrawal fees. You can remove liquidity at any time."'' | |||

=== Upgrades === | === Upgrades === | ||

=== Staking === | === Staking === | ||

* Works similar as other [[Escrow Contract|veTokens]] like [[Curve Finance (CRV)|Curve]] pioneered. | |||

=== Liquidity Mining === | === Liquidity Mining === | ||

Latest revision as of 05:05, 11 August 2023

Basics

History

Audits & Exploits

- Bug bounty program can be found [insert here].

Bugs/Exploits

Governance

Admin Keys

- From their docs (7-2023):

"Emergency "Council": A dedicated Council with Lynex core team members initially and later joined by community members and DeFi experts is empowered with important functions. They have the authority to take actions such as killing unproductive gauges, halting LYNX emissions to them, reviving killed gauges, and modifying the MSIG address."

DAO

Notable Governance Votes

Treasury

- From the docs (7-2023):

"A total of 16% from the initial supply has been set aside for the DAO treasury. This allocation will be locked in veLYNX for 24 months and used to vote on the most capital-efficient and profitable pairs. Additionally, the fee revenue generated will be utilized to cover operational expenses of the DAO."

The treasury is in the hands of the team:

"A 4% portion of the emissions is allocated to the treasury. The LYNX tokens in the treasury are used at the team's discretion to support various initiatives, including incentivizing core pools, funding developments, and marketing. The team has the flexibility to allocate these tokens strategically for the benefit of the project and its ecosystem."

Token

Launch

Token Allocation

For all the exact numbers, check out their docs (7-2023).

Inflation

- LPs will be paid by LYNX inflation, veLYNX holders will be compensated by fees and rebases. veLYNX mechanics include a rebase capped at 52% with a weekly decrease.

""W

Weekly emissions (at inception): 5,000,000 $LYNX.

- Weekly emissions decay: 1%

- Weekly developer wallet allocation: 4%

- Weekly veLYNX rebases: Starts capped at 52% then the cap is reduced by 1% every week for 52 weeks until it reaches 0%

- Emissions for liquidity providers: starts at 44% and grows up to 96% in the a period of 52 weeks."

Utility

Burns

- From the docs (7-2023):

"The DAO Treasury holds veLYNX tokens to optimize liquidity and collect swap fees. These fees are used for various operational activities, such as LYNX token buybacks and burns, bribing core pools, and funding development efforts."

Other Details

Coin Distribution

Technology

- Whitepaper or docs can be found [insert here].

- Code can be viewed [insert here]. Based off of forks of Solidly, Velodrome and Thena

- Deployed on Linea

How it works

Fees

- From the docs (7-2023):

"The trading fees on Lynex are kept in the same tokens being traded. The fees are dynamic and based on market conditions and volatility.

You can provide liquidity without staking the LP tokens. In this case, you may earn all of the trading fees for your proportionate share of the pool. There are no deposit or withdrawal fees. You can remove liquidity at any time."

Upgrades

Staking

Liquidity Mining

Other Details

Oracle Method

Their Other Projects

Roadmap

- Can be found [Insert link here].

Revenue

Usage

Projects that use or built on it

Competition

Other DEXs on Linea

Pros and Cons

Pros

Cons

Team, Funding and Partners

Team

- Full team can be found [here].

- Some of its team comes from Apeswap

Funding

Partners

Partnered with Linea and Linea Bank

(:

Knowledge empowers all and will help us get closer to the decentralized world we all want to live in!

Making these free wiki pages is fun but takes a lot of effort and time.

If you have enjoyed reading, tips are appreciated :) This will help us to keep expanding this archive of information.